How I Bought My First Home at 21: Home Ownership for Young Men

Unlock the secrets to early home ownership as a young man. Learn how I bought my first home at 21 and take control of your future.

Buying a home at a young age might sound like a distant dream, but with determination, smart money management, and a hunger for knowledge, it can actually become a reality. In this blog post, I will take you through my personal journey of how I financed my own home at the age of 21, and I'll show you how you can do it too.

Start Working and Saving Early: I started working when I was just 16 and made a commitment to save every penny I earned. By starting early and being disciplined about saving money, I was able to accumulate a significant amount by the time I turned 21.

Buy a Budget-Friendly Car: Instead of splurging on an expensive car, I chose to purchase a salvaged Honda Civic for under $5,000. This allowed me to have reliable transportation without breaking the bank, freeing up more funds for saving towards my home.

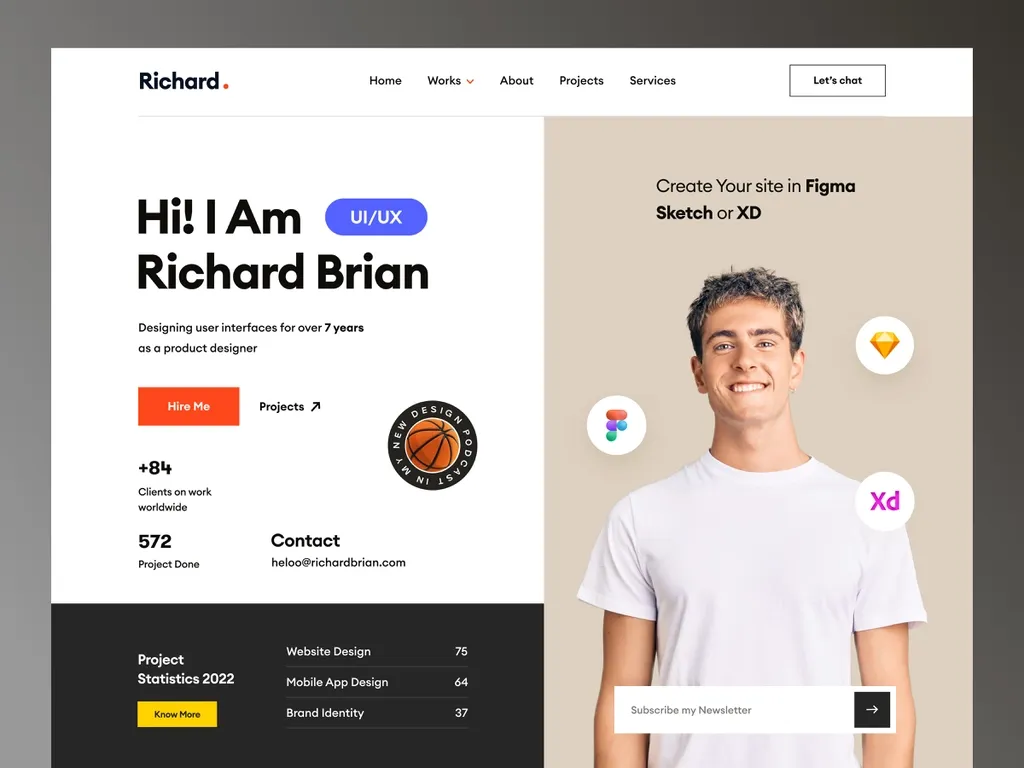

Learn New Skills Online: Throughout the ages of 16 to 21, I dedicated my free time to learning new skills online, especially in the field of computer science. Many resources are available for free, allowing you to acquire valuable knowledge and expertise without spending a fortune.

Build a Portfolio with Side Projects: To showcase my skills and stand out from the crowd, I consistently worked on side projects in my spare time. This not only helped me build a strong portfolio but also demonstrated my passion and commitment to potential employers.

Increase Your Value in the Job Market: By continuously learning and gaining experience, I was able to secure a pay raise to $31 per hour at the age of 20. Investing in yourself and becoming knowledgeable in your field can make you a valuable asset to employers, leading to higher wages and better opportunities.

Build Credit Responsibly: At 19, I opened a credit card with my brother as a cosigner. Using it responsibly and making timely payments helped improve my credit score, making it easier for me to qualify for a home loan later on.

Save, Save, Save: By the time I turned 21, I had managed to save an impressive $25,000 and achieved a good credit score of 730. This, combined with favorable interest rates, set the stage for my homeownership journey.

Renting vs. Buying: I carefully considered the pros and cons of renting versus buying. After doing the math, I realized that the monthly payments for owning a home would be similar to what I would pay in rent.

Utilize First-Time Homebuyer Programs: Taking advantage of a first-time homebuyer loan, I was able to put down only 4% (amounting to $15,000) on a $380,000 home at a rate of 2.8%. Additionally, my loan agent structured the loan in a way that incorporated Private Mortgage Insurance (PMI) into the loan, spreading out the payments over a longer period and keeping my monthly payments lower.

Find the Right Property: I found a great deal on a 3-bedroom, 2.5-bathroom townhome with 1,400 square feet of space. It was built within the last 15 years, ensuring modern amenities and minimizing the need for immediate repairs or renovations.

Manage Monthly Expenses: After factoring in mortgage payments, escrow, and utilities, my monthly expenses added up to around $2,500. With a take-home pay of approximately $4,000 after taxes, I had about $1,500 left for other living expenses such as my car, food, and entertainment.

Embrace the Power of Roommates: To save even more money, I decided to get two roommates. Having roommates significantly reduced my living expenses and allowed me to save more towards my future goals. It has been a game-changer for me, both financially and socially.

While my journey may not be replicable for everyone, it proves that with dedication, sacrifice, and a strong desire to succeed, you can achieve your dreams at a young age. By starting early, learning valuable skills, saving diligently, and making wise financial decisions, you too can embark on the path to homeownership. Remember, with the right mindset and determination, nothing is impossible.